-

Technology stocks: Technology continues to dominate the global economy, and investing in tech companies with strong growth potential could pay off in the long run.

Technology stocks have been some of the most lucrative investments in recent years, and they continue to show strong growth potential in 2023. The technology sector includes companies involved in software development cloud computing, e-commerce, social media, and other innovative technologies.

Some of the biggest names in the technology sector include Apple, Microsoft, Amazon, Facebook, and Alphabet (Google), which have all shown impressive growth over the past decade. However, there are also many smaller tech companies with strong potential for growth, particularly in emerging fields such as artificial intelligence, blockchain, and cybersecurity.

Investing in technology stocks can be risky, as these companies tend to be highly valued and can be subject to volatility. However, for those willing to take on more risk, the potential rewards can be significant. It's important to do your research and carefully evaluate a company's financials, growth potential, and competitive advantages before investing. Consulting with a financial advisor can also help you make informed investment decisions in the tech sector.

-

Renewable energy: As the world shifts towards more sustainable energy sources, companies in the renewable energy sector could experience significant growth.

Renewable energy is becoming an increasingly important investment opportunity as the world transitions towards more sustainable energy sources. The renewable energy sector includes companies involved in solar, wind, hydro, and geothermal power generation, as well as energy storage and energy efficiency solutions.

Investing in renewable energy can offer both financial and environmental benefits. As demand for clean energy grows, companies involved in the renewable energy sector could experience significant growth and provide attractive returns for investors. Additionally, investing in renewable energy can help reduce carbon emissions and promote a more sustainable future.

Some of the biggest names in the renewable energy sector include Tesla, NextEra Energy, and Brookfield Renewable Partners, among others. However, there are also many smaller companies involved in renewable energy development that could offer strong growth potential.

It's important to do your research and evaluate a company's financials, growth potential, and competitive advantages before investing in the renewable energy sector. Consulting with a financial advisor who specializes in sustainable investing can also help you make informed investment decisions in this rapidly growing field.

-

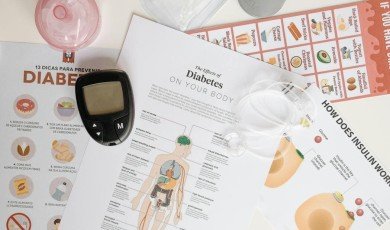

Healthcare: The aging population and increasing demand for healthcare services make healthcare companies a potentially lucrative investment.

The healthcare sector can be a promising investment opportunity for those looking for long-term growth potential. The healthcare industry includes companies involved in pharmaceuticals, medical devices, healthcare services, and biotechnology, among others.

One of the biggest factors driving growth in the healthcare sector is the aging population and increasing demand for healthcare services. As people live longer and face more health challenges, there is a growing need for new and innovative healthcare solutions.

Some of the biggest names in the healthcare sector include Johnson & Johnson, Pfizer, Merck & Co., and Abbott Laboratories, among others. However, there are also many smaller companies involved in healthcare innovation that could offer strong growth potential.

Investing in the healthcare sector can be complex, as it involves navigating regulatory hurdles, drug development pipelines, and changing market dynamics. It's important to do your research and carefully evaluate a company's financials, growth potential, and competitive advantages before investing. Consulting with a financial advisor who specializes in healthcare investing can also help you make informed investment decisions in this rapidly evolving industry.

-

Real estate: Despite the pandemic-induced economic slowdown, the real estate market has shown resilience and could offer attractive investment opportunities.

Investing in real estate can provide an opportunity for long-term growth and income generation. The real estate sector includes companies involved in property development, property management, and real estate investment trusts (REITs).

Despite the pandemic-induced economic slowdown, the real estate market has shown resilience and could offer attractive investment opportunities in 2023. As the economy recovers, demand for housing and commercial real estate is expected to increase, driving growth in the real estate sector.

Some of the biggest names in the real estate sector include Simon Property Group, Prologis, Equity Residential, and AvalonBay Communities, among others. However, there are also many smaller companies involved in real estate development and management that could offer strong growth potential.

Investing in real estate can involve various risks, including market volatility, interest rate changes, and regulatory changes. It's important to do your research and carefully evaluate a company's financials, growth potential, and competitive advantages before investing. Consulting with a financial advisor who specializes in real estate investing can also help you make informed investment decisions in this dynamic sector.

-

Cryptocurrencies: While cryptocurrencies are still volatile and largely unregulated, they have become increasingly popular among investors, and some analysts believe they could become mainstream in the coming years.

-

Consumer staples: Consumer staples such as food, household goods, and personal care items tend to be more resilient during economic downturns and could offer stability in uncertain times.

-

Emerging markets: Many emerging economies are experiencing rapid growth and could offer attractive investment opportunities for those willing to take on more risk.

-

Infrastructure: Governments around the world are investing in infrastructure projects to boost their economies, and companies involved in infrastructure development could benefit from these investments.

-

ESG (environmental, social, and governance) investing: Investors are increasingly interested in investing in companies that prioritize sustainability, ethical practices, and social responsibility.

-

Dividend-paying stocks: Dividend-paying stocks can provide a steady source of income for investors, particularly in times of market volatility.

It's important to remember that investing always involves risk, and it's crucial to do your research and consult with a financial advisor before making any investment decisions.